The only way for financial services firms to be reputable in their industry is by complying with regulations, keeping up with industry trends, and using new technologies. The firm will be able to manage their clients’ funds while protecting their clients’ valuable and sensitive data when they use innovative solutions in their operations.

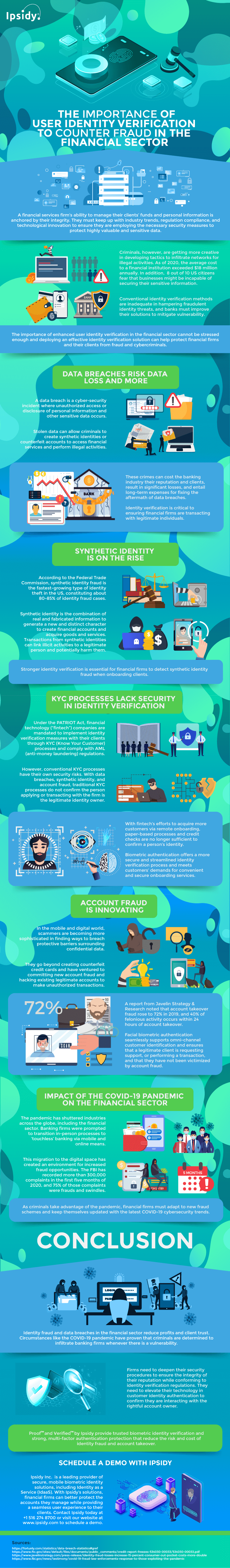

Conventional and outdated user identity verification measures are not enough to hamper the criminals’ efforts to infiltrate otherwise secure networks and conduct fraudulent activities. In fact, 8 out of 10 Americans fear that financial institutions are incapable of protecting their sensitive information.

Banks must update their systems and deploy enhanced user identity verification solutions to mitigate the risk of fraud and cybercrime. Among the risks that firms must be prepared to face are data breaches, synthetic identities, account fraud, and other cybercrimes. These cybersecurity issues can reduce a firm’s profits and client trust, cause costly long-term expenditures, and other significant losses.

Fintech or Financial Technology companies are mandated under the PATRIOT act to implement identity verification measures through their KYC or Know Your Customer processes and comply with AML or Anti-Money Laundering regulations. Traditional KYC processes like remote onboarding, paper-based processes, and credit checks are insufficient to secure the customer’s identity. Such companies must use more secure solutions like biometric identification solutions to streamline the identity verification process while meeting their clients’ needs for secure and convenient onboarding services. Facial biometrics can ensure that the person requesting support is not someone with a false identity.

Financial firms can mitigate the security risks that the COVID-19 pandemic brought on the financial sector when using a reliable identity authentication solution. The pandemic forced multiple industries to adapt to the global situation and go online, making it easier to commit fraud and other illegal activities. Banks are forced to transition in-person process to online and mobile banking, increasing the opportunities to commit fraud, to the point that the Federal Bureau of Investigation received 300,000 complaints on frauds and scams in the first five months of the year 2020. According to the Federal Trade Commission, about 80-85% of fraud cases today are made up of synthetic fraud, which is currently the fastest-growing type of identity theft.

Many criminals took advantage of the pandemic, and financial firms must ensure that they can effectively counter fraud. The novel coronavirus pandemic opened up a new business landscape rife with new security risks that firms must counter. For more information, see this infographic by Ipsidy.